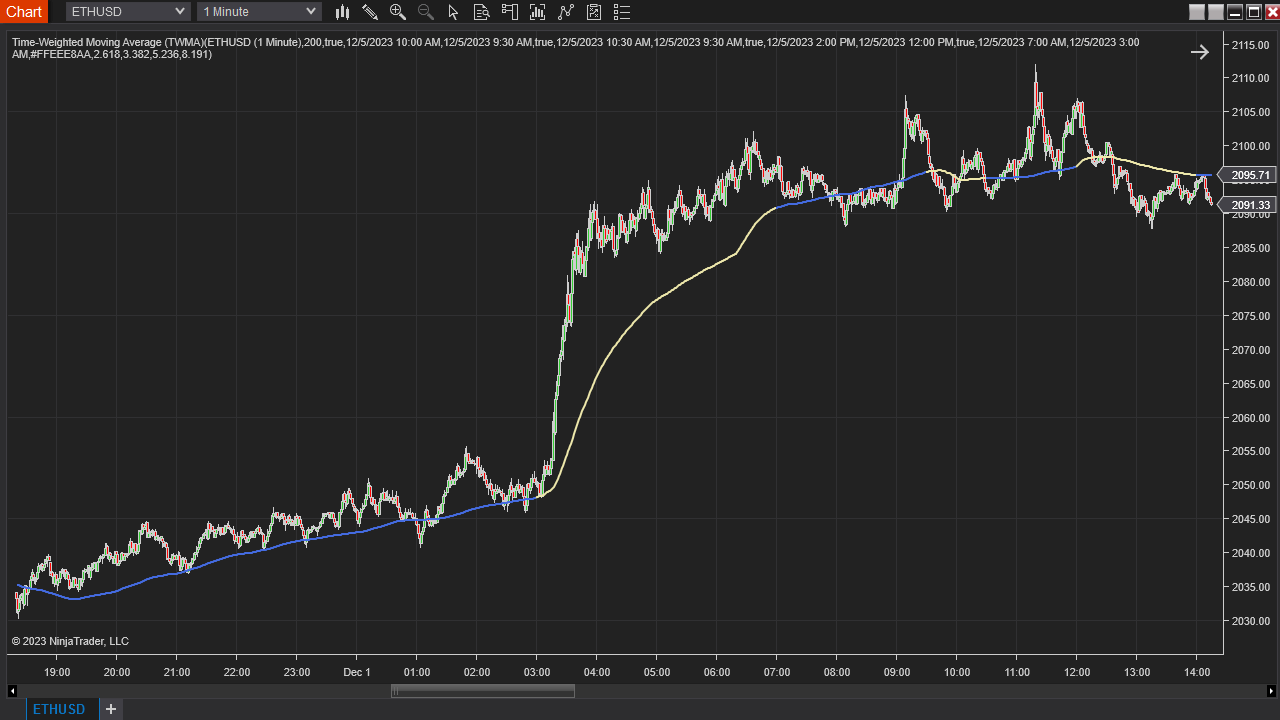

In the ever-evolving landscape of trading, the ability to pinpoint precise market movements is paramount. Enter the Time-Weighted Moving Average (TWMA), an innovative indicator meticulously crafted to empower traders with a granular understanding of market dynamics. This cutting-edge tool doesn’t merely rely on price action but ingeniously incorporates time-based patterns, offering a deeper insight into market behavior.

Understanding TWMA Parameters

TWMA Period

At the heart of this groundbreaking indicator lies the TWMA Period parameter. This pivotal factor delineates the calculation period for the TWMA. Traders can fine-tune this parameter to match their preferred time horizon, be it short-term intraday movements or longer-term trends.

Wt Const(n)

The Wt Const(n) series is a set of parameters allowing traders to define the weight assigned to specific times within the TWMA calculation. This dynamic series empowers users to customize the influence of different time segments on the weighted moving average. By assigning varying weights, traders can effectively emphasize or de-emphasize the significance of price points during distinct time periods.

Weighted Times Group

The Weighted Times Group encompasses a set of four parameters designed to precisely specify the times when the weight constant for prices is applied to the TWMA calculations. This meticulous grouping enables traders to target specific time frames, aligning the indicator’s sensitivity with strategic periods of heightened market activity or volatility.

Leveraging Customization for Strategic Insights

The true power of this TWMA indicator lies in its adaptability. By leveraging the TWMA Period, Wt Const(n) series, and Weighted Times Group, traders can create a tailored analytical framework that resonates with their trading strategy.

Fine-Tuning Time Sensitivity

Adjusting the TWMA Period allows traders to zoom in or out of market movements, capturing either micro-level fluctuations or broader trend perspectives. This flexibility ensures adaptability across various trading styles and preferences.

Precision through Weight Customization

The Wt Const(n) series empowers traders to assign specific weights to distinct time segments, amplifying or reducing their influence within the TWMA calculation. This precision-based approach facilitates a nuanced analysis, giving prominence to strategic time intervals.

Strategic Time Emphasis

The Weighted Times Group facilitates the identification and incorporation of strategic time frames into the TWMA calculations. By pinpointing periods of increased market activity or volatility, traders can enhance the indicator’s responsiveness during these crucial junctures.

Conclusion

In the realm of trading, information is power. The Customizable Time-Weighted Moving Average (TWMA) indicator puts this power in your hands. By offering a unique blend of price action and time-based analysis, this indicator stands as a testament to the evolving landscape of technical analysis, providing traders with a comprehensive tool for navigating the markets with precision and insight.